Business inventories ap macro introduces you to the essential function that inventories play in shaping the broader economy, offering insight into how these often overlooked holdings can signal shifts in growth, recessions, and economic health. From the stockrooms of manufacturers to the shelves of retailers, business inventories are more than just physical goods—they’re key indicators that help economists and policymakers decode the rhythm of the business cycle.

This topic explores the definition and importance of business inventories in macroeconomics, demonstrating their crucial role in measuring national output and influencing GDP. You’ll learn how inventory changes ripple through the economy, affecting aggregate demand, business cycles, and ultimately, the strategies businesses adopt during periods of uncertainty or rapid expansion. Through clear examples, tables, and real-world scenarios, you’ll see how inventory management responds to everything from consumer demand shifts to unexpected economic shocks.

Definition and Importance of Business Inventories in AP Macro

Business inventories are a fundamental component of macroeconomic analysis, particularly in measuring national output and assessing economic health in AP Macroeconomics. Inventories include all goods that businesses have produced but not yet sold. This covers everything from raw materials waiting to be processed, to finished products sitting on warehouse shelves. By tracking how inventories change over time, economists gain critical insights into demand trends, production efficiency, and the direction of the overall economy.

The significance of inventories goes beyond just what’s sitting in storage. Changes in inventory levels directly influence Gross Domestic Product (GDP) calculations, reflecting whether goods are being produced faster than they are sold, or vice versa. Rising inventories may signal slowing demand or optimistic production, while declining inventories can indicate robust sales or production delays.

Types of Business Inventories

Understanding the different types of business inventories helps clarify how they interact with the broader economy. Each type plays a unique role in the production and sales cycle.

- Raw Materials: Basic inputs that businesses will use in the production process but have not yet been converted to finished goods.

- Work-in-Progress (WIP): Items that are in the process of being manufactured but are not yet complete. For example, partially assembled cars on a factory floor.

- Finished Goods: Completed products ready for sale to customers but not yet sold. This could include unsold electronics in a warehouse.

- Maintenance, Repair, and Operating (MRO) Supplies: Items used in the production process or to maintain equipment, but not part of the final product, such as lubricants or cleaning agents.

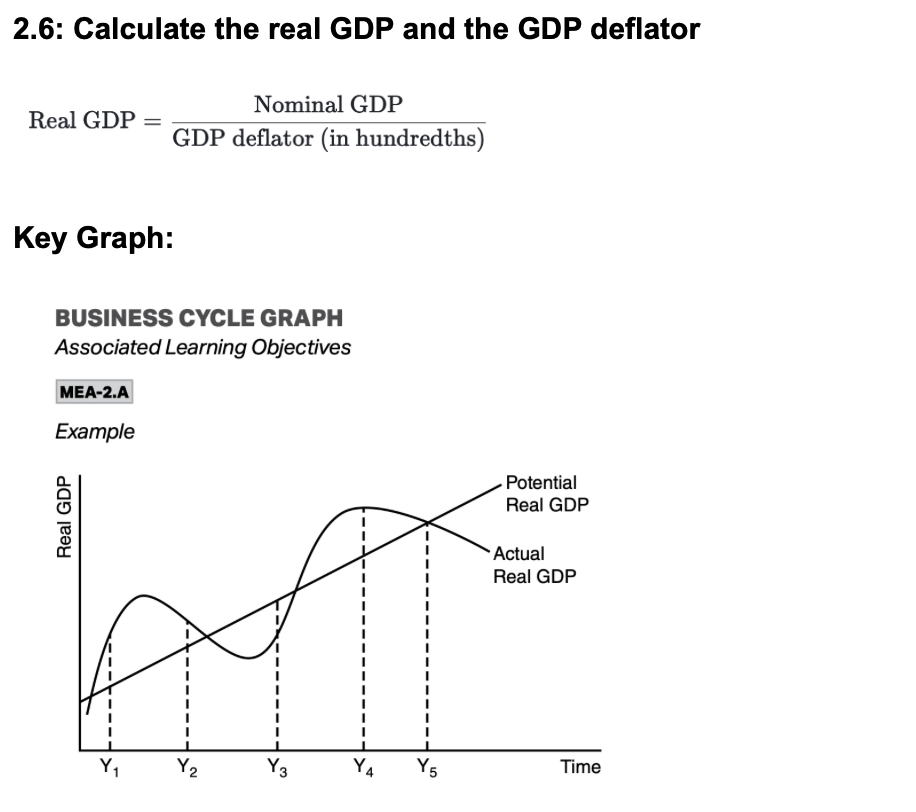

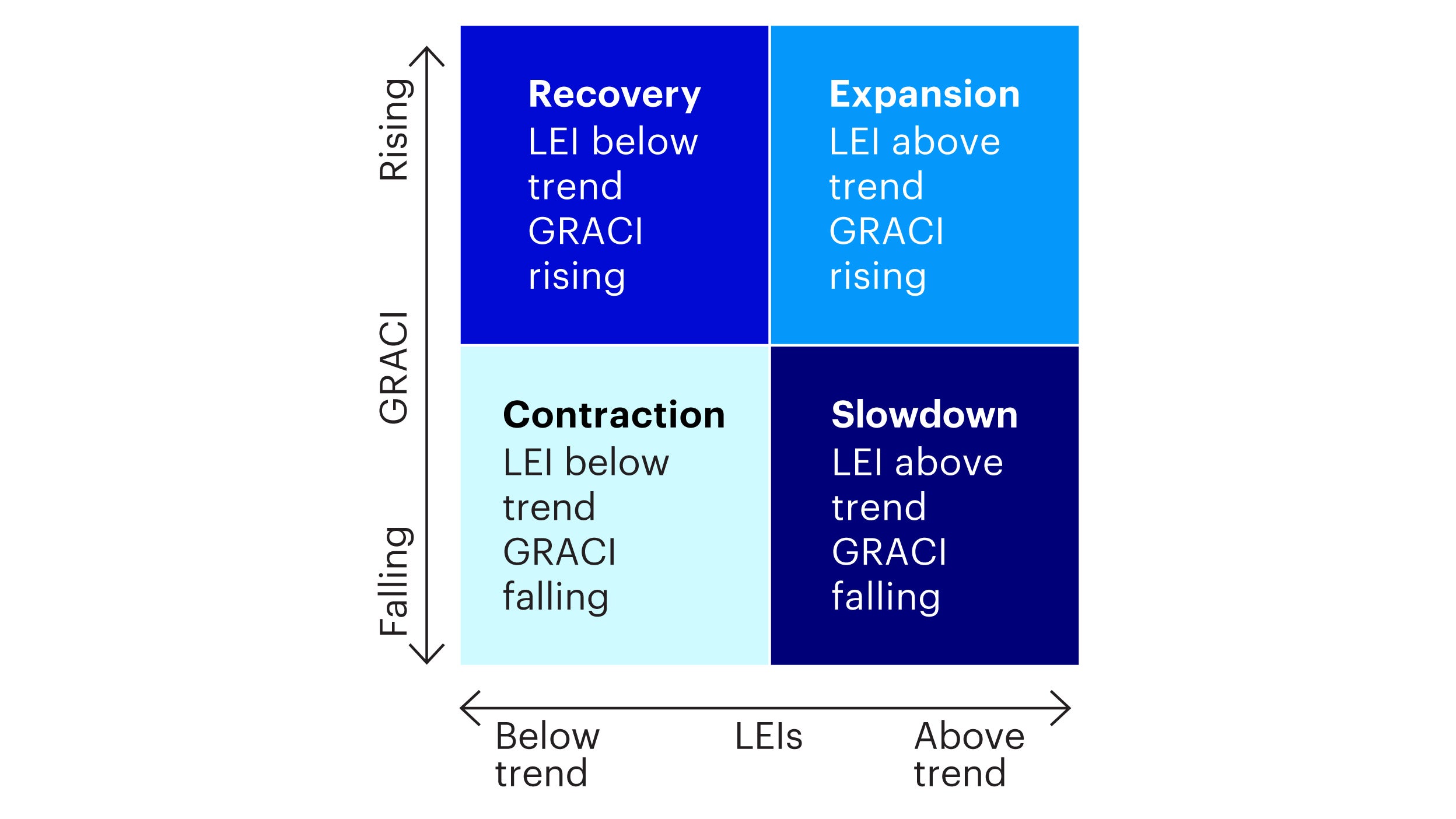

Role of Business Inventories in the Business Cycle: Business Inventories Ap Macro

Business inventories are closely tied to the business cycle, which describes the rise and fall of economic activity over time. Changes in inventory levels can amplify economic fluctuations. When inventories accumulate, it may indicate that sales are slowing, potentially leading to production cuts and job losses. Conversely, when inventories fall, it can signal strong demand, prompting businesses to ramp up production and hire more workers.

The relationship between inventory changes and the business cycle is particularly evident during expansions and recessions. During expansions, firms deplete inventories to meet strong demand and may eventually increase production. During recessions, inventories often build up as demand slows, causing firms to scale back production.

| Phase | Inventory Trend | Economic Impact | Example |

|---|---|---|---|

| Expansion | Decreasing or Stable | Rising GDP, increased employment, stronger sales | Retailers selling out holiday stock faster than restocking |

| Peak | Low or Even | Strong demand, high production, possible supply constraints | Automakers operating at full capacity with minimal unsold cars |

| Contraction (Recession) | Increasing | Falling GDP, layoffs, reduced production | Electronics manufacturers holding onto unsold TVs as demand drops |

| Trough | High, then Declining | Inventories start to clear out, production may begin to recover | Wholesalers offer discounts to move excess stock as economy recovers |

Inventory Investment and Its Effect on GDP

Inventory investment represents the change in the value of unsold goods, and it is included as a component of GDP within the expenditure approach. When inventories increase, it means more goods have been produced than sold, contributing positively to GDP. A decrease in inventories indicates that sales have outpaced production, which subtracts from GDP for that period.

Both planned and unplanned changes in inventories influence GDP differently. Planned changes occur when firms deliberately adjust inventory levels, while unplanned changes result from unexpected fluctuations in demand.

| Inventory Type | Description | GDP Effect | Example |

|---|---|---|---|

| Planned Inventory Investment | Deliberate increase or decrease to prepare for anticipated demand changes | Positive if increasing, negative if decreasing | Retailer stockpiling products ahead of peak season |

| Unplanned Inventory Investment | Unexpected increase due to lower than expected sales, or decrease due to higher than expected sales | Positive if inventories build up, negative if they fall | Manufacturer stuck with extra inventory after demand drops suddenly |

Estimating inventory investment in national income accounting is typically done by tracking business reports on inventory levels and adjusting for inflation or valuation changes. Economists rely on surveys, statistical models, and sector-specific data to capture accurate inventory movements for GDP calculations.

Causes of Inventory Accumulation and Depletion, Business inventories ap macro

Inventory accumulation or depletion within firms results from a variety of operational and market factors. These shifts can significantly influence production decisions, supplier relations, and financial performance.

The main differences between overestimating and underestimating demand directly affect inventory outcomes. Overestimation leads to unwanted inventory buildup, while underestimation causes stockouts and lost sales opportunities.

- Sudden drops in consumer demand following an economic shock, leaving firms with surplus stock.

- Supply chain disruptions delaying the arrival of raw materials, resulting in depleted inventories.

- Poor sales forecasting, leading to either overproduction or underproduction.

- Seasonal demand miscalculations, such as overstocking holiday goods that don’t sell as expected.

- Technological changes making existing inventory obsolete faster than anticipated.

Impact of Business Inventories on Aggregate Expenditure and Aggregate Demand

Inventory adjustments play a crucial role in shaping aggregate expenditure, which is the total amount spent on goods and services in an economy. When inventories increase unexpectedly, firms may cut back on new production, lowering aggregate expenditure and, in turn, aggregate demand. Conversely, when inventories fall below desired levels, companies boost production, raising both aggregate expenditure and demand.

Here’s a step-by-step sequence illustrating the multiplier effect triggered by inventory changes:

- Firms experience an unexpected drop in inventory as sales outpace production.

- To replenish stock, firms increase orders for materials and ramp up production.

- This higher production leads to increased income for employees and suppliers.

- As incomes rise, so does consumer spending, further boosting demand for goods and services.

- The initial inventory adjustment thus multiplies throughout the economy, amplifying the impact on aggregate demand.

These adjustments create a feedback loop, where changes in inventories influence production decisions, which then affect household incomes and ultimately shape overall demand in the economy.

Inventory Management Strategies in Macroeconomic Context

Businesses adopt different inventory management strategies depending on the economic climate to balance the risks of stockouts and overstocking. Effective inventory management helps firms remain agile, minimize costs, and respond quickly to demand changes.

| Strategy | Economic Condition | Benefits | Drawbacks |

|---|---|---|---|

| Just-in-Time (JIT) | Stable or predictable demand | Reduces holding costs, minimizes waste | Vulnerable to supply chain disruptions |

| Safety Stock | Uncertain or volatile demand | Prevents stockouts, ensures readiness | Higher storage costs, risk of obsolescence |

| Lean Inventory | Recessions or downturns | Conserves cash, reduces excess stock | May lead to missed sales if demand rebounds unexpectedly |

| Bulk Purchasing | Boom periods with strong demand | Secures lower unit costs, meets high demand | Ties up capital, risk if demand falls suddenly |

For example, during a recession, a consumer electronics company might shift to lean inventory management, ordering only what is certain to sell, while during a boom, the same firm might increase its raw material stockpile to avoid shortages and capitalize on rising sales.

Illustration: Business Inventories Adjustment during Economic Shocks

Economic shocks, such as sudden recessions or disruptions in the global supply chain, force firms to make rapid inventory adjustments. During the COVID-19 pandemic, for instance, many companies faced both demand collapses and bottlenecks in obtaining components.

A common scenario unfolds when a firm suddenly sees orders drop. Warehouses fill up with unsold goods, pushing managers to halt new production, negotiate discounts with suppliers, and focus on liquidating existing stock before resuming normal operations.

When a major auto manufacturer faced a sharp demand drop due to a global recession, it responded by suspending new vehicle production and offering incentives to clear dealership inventories. The company also renegotiated contracts with suppliers for delayed parts deliveries, gradually resuming production only as dealership stock returned to manageable levels. This stepwise approach helped minimize losses during the downturn and positioned the firm for a faster recovery as market conditions improved.

Final Wrap-Up

In summary, understanding business inventories ap macro provides a powerful lens for interpreting economic trends and business decisions. By tracing how inventory levels interact with aggregate demand, GDP, and the phases of the business cycle, you gain a deeper appreciation for the strategic balancing act faced by firms and policymakers alike. Whether you’re preparing for exams or just curious about how businesses adapt to economic turbulence, mastering this topic equips you with practical knowledge to connect theory and real-world events.

Essential FAQs

How do business inventories affect GDP calculations?

Changes in business inventories are part of the investment component in GDP. Rising inventories are counted as positive investment, while declining inventories subtract from GDP.

Why do businesses hold inventories?

Businesses hold inventories to meet sudden changes in demand, buffer against supply chain disruptions, and maintain smooth production processes.

What is the difference between planned and unplanned inventory changes?

Planned inventory changes are intentional and based on forecasts, while unplanned changes occur when actual sales differ from expected sales, affecting economic outcomes.

How can inventory levels signal an upcoming recession?

When businesses accumulate excess inventory due to weaker-than-expected demand, it often signals slowing economic activity and may precede a recession.

Do all types of inventory impact the economy equally?

No, different types of inventory (raw materials, work-in-progress, finished goods) may have varying economic impacts depending on where supply chain disruptions or demand changes occur.